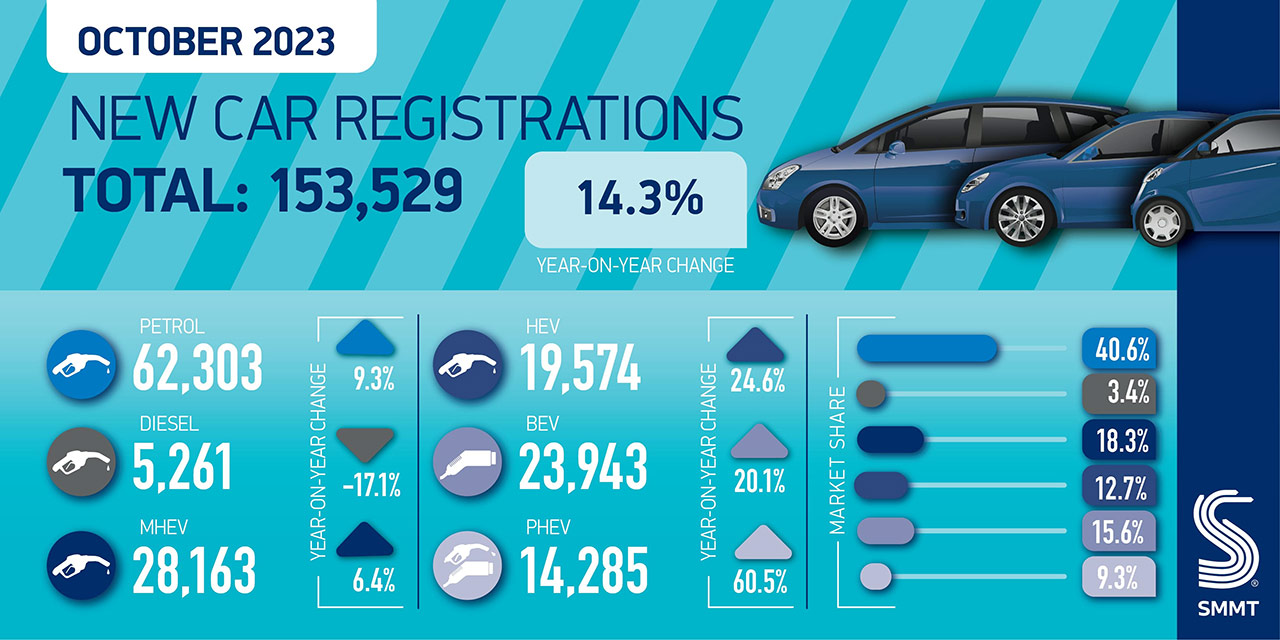

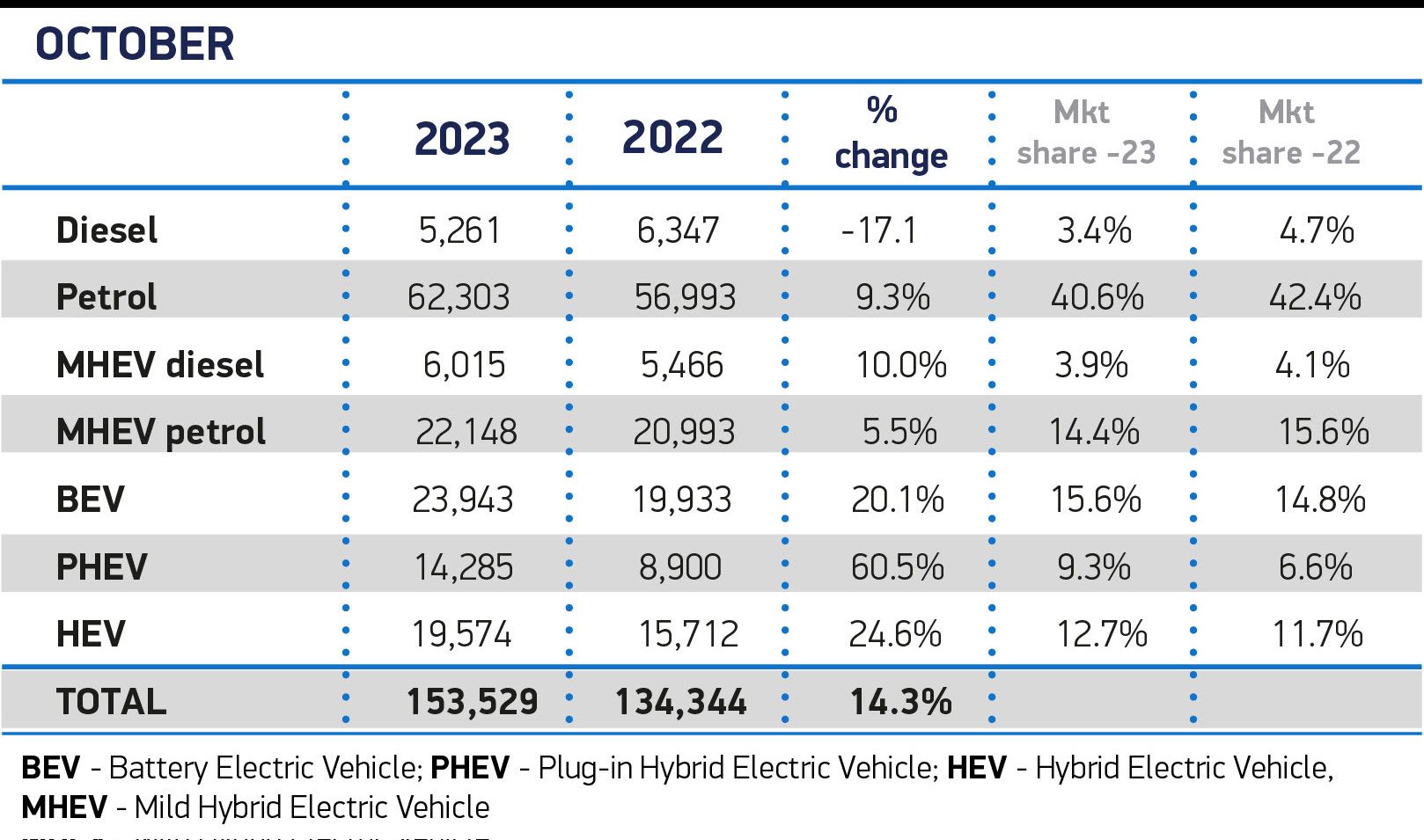

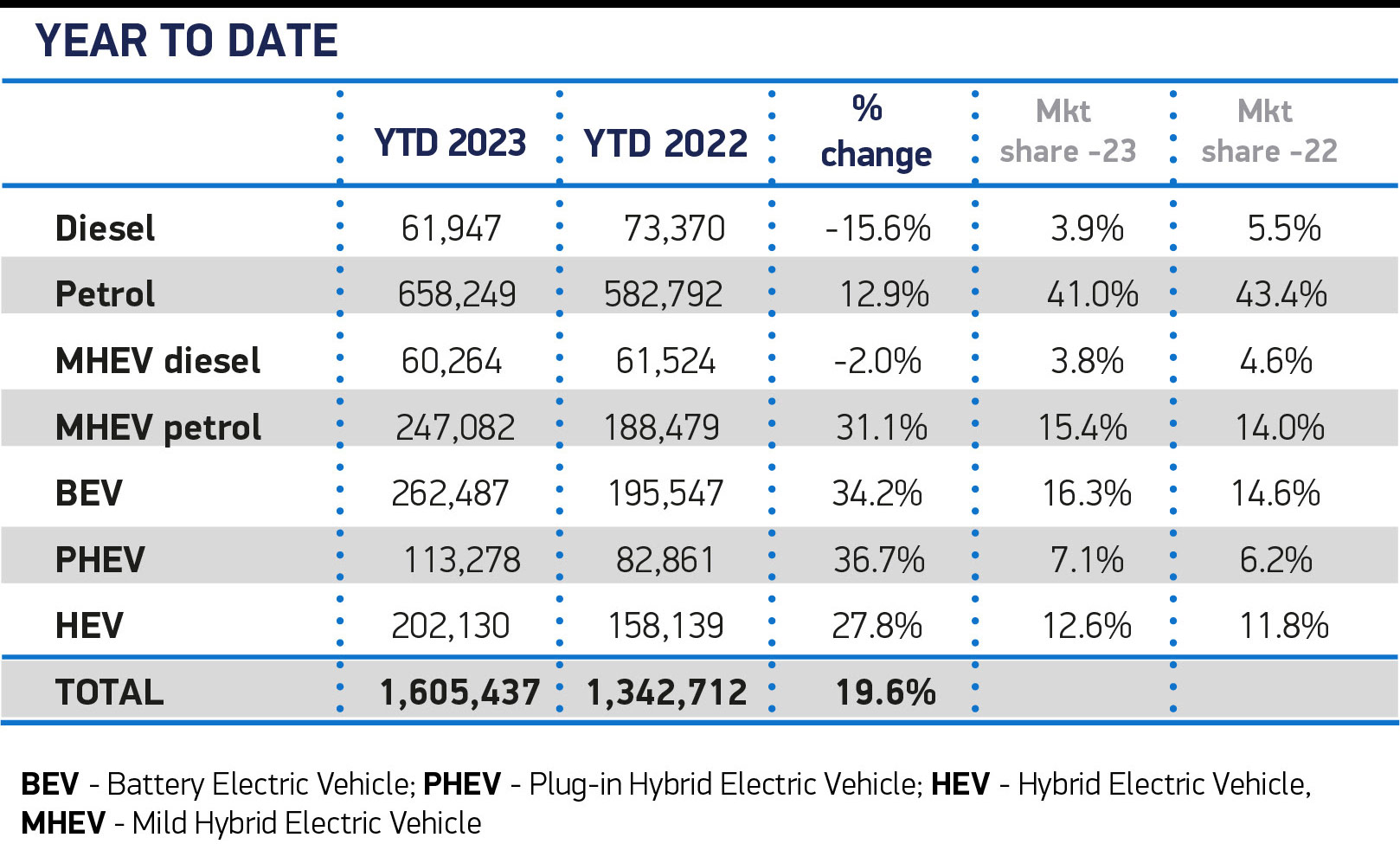

The UK's new car market experienced a significant boost in October, as more and more drivers move across to some form of electric propulsion, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). Based on the new data, the UK is expected to buy around 400,000 Battery Electric Vehicles (BEV) in 2024 – on top of the 324,000 expected to have been sold by the end of 2023.

October 2023 saw the 42nd consecutive month of growth in the sale of BEVs, with an increase over last October of more than 20%. Hybrid vehicles enjoyed a massive increase in sales, ahead of the expected launch of many more affordable BEVs over the next three years.

Looking back five years (before the big move toward BEVs started), the average price of a new car in the UK was close to £22,000 with products like the Ford Focus leading the way at just under £20,000. So far, despite using far fewer components in order to build an EV, the average price of BEV products on sale in the UK for 2023 remains over £45,000.

The challenge for the car industry, is that BEVs are likely to require a lot less aftercare/servicing than their fossil-fuel powered predecessors. Huge increases in driver safety technology are also likely to reduce the new for after-market spare parts as we move toward an era where car accidents are significantly reduced.

Four years ago, WhichEV reported on the warnings being given by the Chairman of the German automotive industry (Bernhard Mattes), when he said that up to 100,000 jobs relating to the car industry could be at risk by a wholesale move toward EVs. While simpler cars that crash less, requiring far fewer spares and a lot less servicing might sound like a dream for consumers – the reality is that car companies still want to show their shareholders that they can increase profits. Until the start of 2023, there was little pressure on the major car makers to move their average selling price down toward the levels seen in pre-BEV days.

Three years ago, WhichEV's editor warned that Tesla was preparing a new EV with a street price closer to $25,000 and that this would be a game changer for the market. We're now hearing that Musk's plan will come to fruition in the near future with plans to begin production in Germany.

It's unclear how much our prediction would have played into the predictions for the size of the UK BEV market going forward, but if Tesla can make an attractive car with good range around the £25,000 mark – then other car makers will be forced to sit up and pay attention.

In the short term future, Tesla would pick up a lot of orders/market share. Other car makers would be forced to drop pricing on existing models or to push through lower-priced options ahead of their original schedule.

In the medium term, launching a Tesla at £25,000 would have a significant impact on the secondhand car market. Drivers and car makers alike, have an idea in their heads of what a given car will be worth in 2-4 years time, after its initial purchase/lease period. A key factor in secondhand values will be the alternative, “What can I buy new for the same kind of money?”.

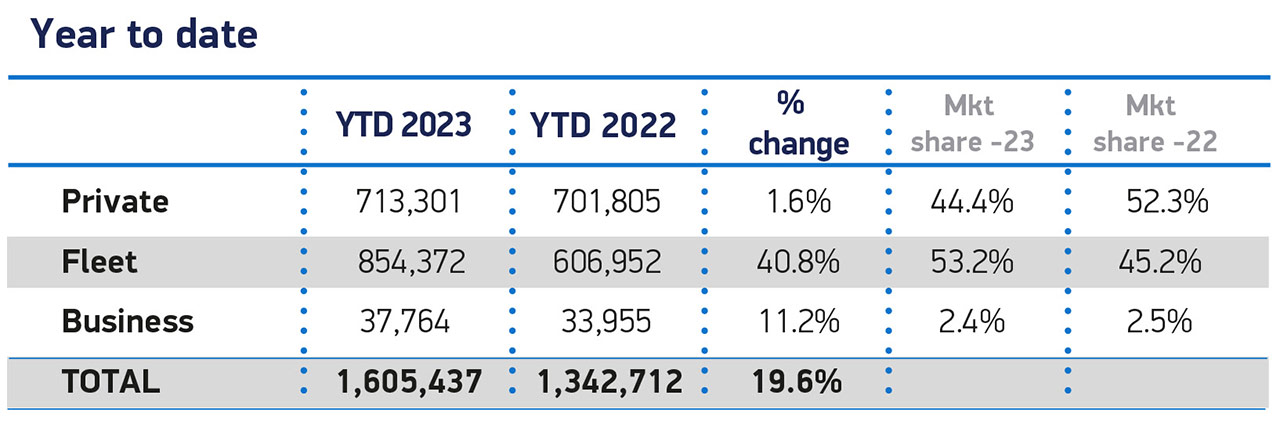

Right now, consumer purchases of EVs are doing OK, but the growth is being driven by fleet/business customers. The lower running costs, lower BiK and reduced service schedules are all very attractive. Offer consumers a high quality EV at £25,000 and the uptake is likely to be strong.

In August, we reported that 40% of all cars registered had an electric motor of some kind for propulsion. In October, that number jumped to 56%. As the move away from polluting fuels continues, so the potential revenue gap increases for the Government – increasing the chances of a new kind of road tax in order to plug the shortfall in petrol/diesel revenues.

Looking at the various types of vehicle with electric motors, hybrid electric vehicles (HEVs) surged by almost 25% to 19,574 units, while plug-in hybrid vehicles (PHEVs) experienced a remarkable 60% growth, totalling 14,285 registrations. Private registrations accounted for less than one in four new BEVs this year, emphasising the need for lower priced products and improved charging infrastructure.

October’s electric vehicle sales increase follows a significant increase in chargepoint rollout in Q3, with 4,753 new standard chargepoints coming online – the largest quarterly delivery to date. However, concerns arise as installation was disproportionately focused on London and the South East, receiving four out of five new chargepoints commissioned during the quarter, despite the region accounting for fewer than two in five new plug-in registrations during the same period.

The uneven distribution raises questions about accessibility and availability, as Electric Vehicle (EV) uptake is significantly influenced by perceptions of chargepoint infrastructure. Calls for more equitable distribution and pricing for public charging are gaining traction. Suggestions include reducing VAT on public charging to match home use, ensuring fairness for those unable to install their own chargepoint.

Mike Hawes, SMMT Chief Executive, commented on the unexpected growth, stating, “With demand for new cars surpassing pre-pandemic levels in the month, the market is defying expectations and driving growth. As fleet uptake flourishes, particularly for EVs, sustained success depends on encouraging all consumers to invest in the latest zero-emission vehicles.”

Hawes highlighted the upcoming Autumn Statement as a crucial opportunity for the government to introduce incentives and facilitate infrastructure investment, signalling strong support for drivers to make the switch to electric vehicles.

Overall, it's worth remembering that the automotive industry remains a vital part of the UK economy, contributing £78 billion in turnover and £16 billion in value added. The sector typically invests around £3 billion each year in Research and Development (R&D) and employs over 208,000 people in manufacturing and 800,000 across the wider sector. Exports from the automotive industry contribute £94 billion, accounting for 10% of all UK goods exports.

With more than 25 manufacturing brands building over 70 vehicle models in the UK, supported by 2,500 supply chain businesses and skilled engineers, the industry plays a crucial role in various sectors, including advertising, finance, and logistics. Many of these jobs are distributed outside London and the Southeast, with wages around 14% higher than the UK average.

Discussion about this post