Last updated on September 12th, 2023 at 12:11 pm

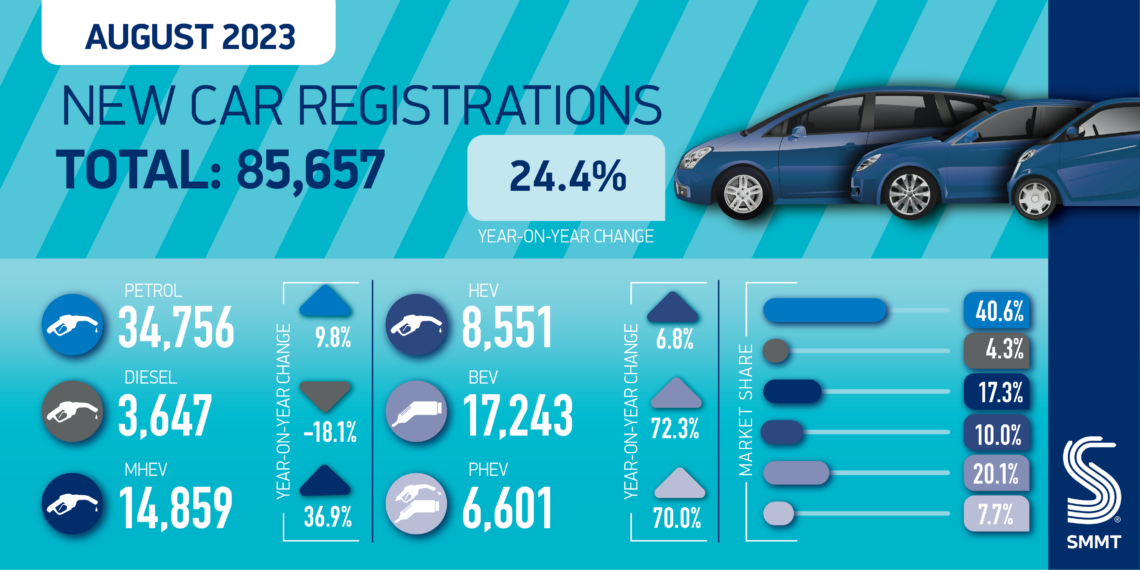

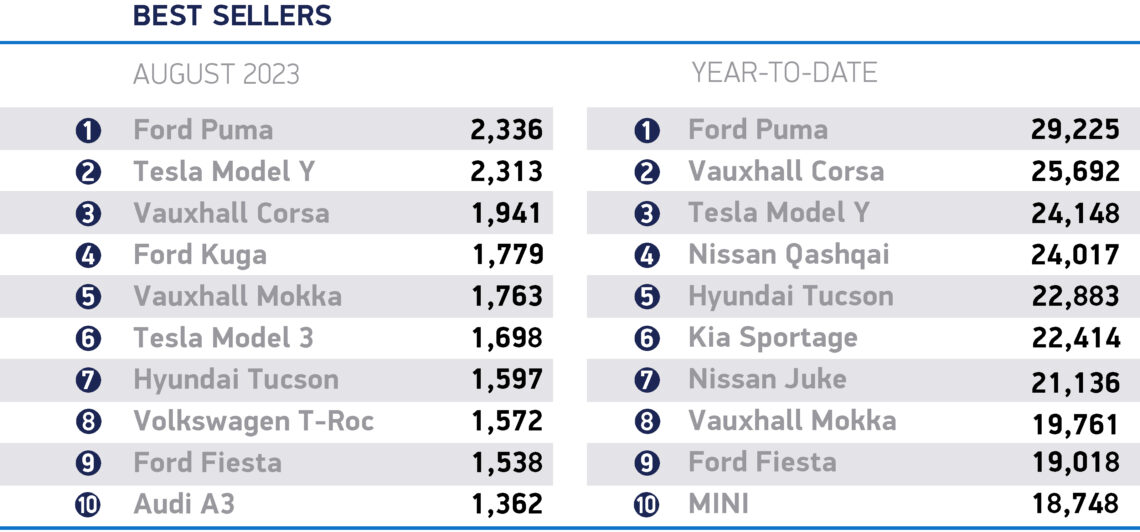

In a promising sign of economic recovery, the UK new car market (overall) witnessed robust growth in August, with a 24.4% increase in registrations, according to data released by the Society of Motor Manufacturers and Traders (SMMT). The surge in registrations, which amounted to 85,657 new vehicles hitting the road, marks the commencement of a second year of growth for the industry. Even though this is still almost 8% below pre-pandemic levels, the actual mix of cars being sold is far greener than 2019.

Typically, August tends to be a quieter month for car sales, as many buyers prefer to wait for the September numberplate change. However, the addition of 16,799 units over the previous year has propelled the industry into positive territory. Large fleets were the primary drivers of this growth, with registrations surging by an impressive 58.4%, reaching 51,951 units. Business registrations also demonstrated resilience, increasing by 39.4% to 1,635 units. Conversely, private demand softened, dropping by almost 8%, which was partly attributed to supply constraints observed in the market in 2022.

A notable highlight in August's performance was the increasing demand for electrified vehicles, which accounted for nearly 40% (37.8%) of new cars registered during the month.

Battery electric vehicles (BEVs) emerged as the stars of the show, with a remarkable 72.3% surge in uptake, securing a new car market share greater than 20%

This achievement represents an August record and is the highest figure recorded since December of the previous year. Plug-in hybrid vehicles (PHEVs) also posted substantial growth, registering a 70% increase, now constituting 7.7% of new vehicle registrations. Meanwhile, hybrid cars maintained relative stability, posting a 6.8% increase and comprising 10% of the market.

However, despite the promising outlook for electrified vehicles, a looming challenge threatens to hamper the industry's progress. With less than four months to go until the anticipated introduction of the Zero Emission Vehicle Mandate, the automotive sector remains in the dark about the proposed regulation's specifics. While the industry has committed to achieving Net Zero emissions, the lack of clarity surrounding the mandate's details poses a significant risk to achieving this goal. To accelerate the shift toward electric vehicles, both businesses and private consumers need stronger incentives, and this is especially vital for the private consumer market, which currently lacks a similar fiscal support package.

Mike Hawes, Chief Executive of SMMT, expressed concern over the uncertain regulatory environment, saying, “With the automotive industry beginning a second year of growth, recovery is underway with EVs energising the market. But with a new Zero Emission Vehicle Mandate due to come into force in less than 120 days, manufacturers still await the details. Businesses cannot plan on the basis of consultations, they need certainty. And now, more than ever, the government must match action to ambition, ensuring there are the incentives and infrastructure in place to convince drivers to make the switch.”

This boost in UK car registrations is a key indicator of the country's overall status. The automotive industry plays a pivotal role in the UK economy, supporting key agendas such net-zero. It contributes £78 billion in turnover and adds £16 billion in value to the UK economy, with an annual investment of approximately £3 billion in research and development. The sector employs over 208,000 people in automotive manufacturing and approximately 800,000 across the wider automotive ecosystem. Notably, automotive-related manufacturing accounts for exports worth £94 billion, representing 10% of all UK goods exports.

Looking at these numbers, we can only imagine how things will change if a new wave of highly affordable electric vehicles are launched into the market by BYD, Dacia, Tesla and others.

Discussion about this post