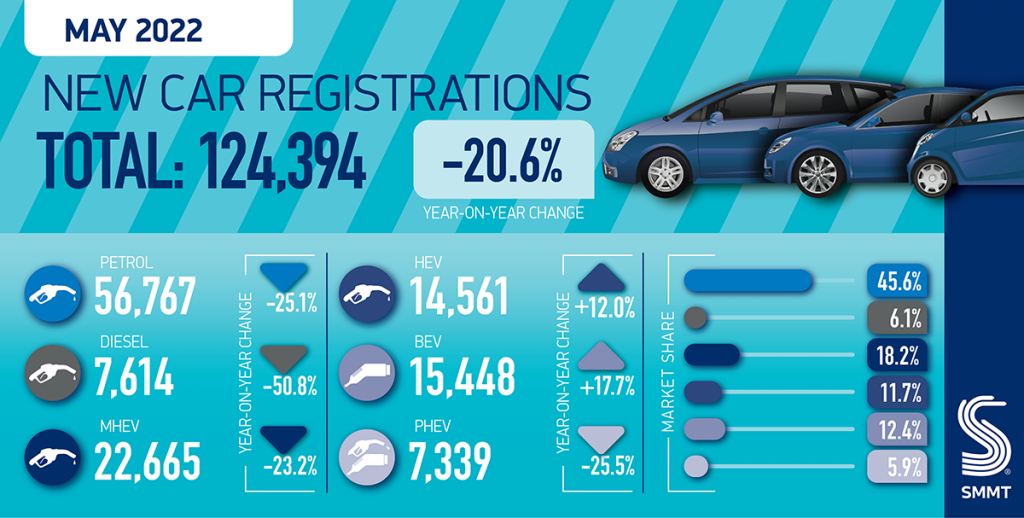

EVs have bucked the market again in another poor month for vehicle sales. UK new car registrations fell 20.6 per cent to 124,394 units as supply constraints held back deliveries, making it the second weakest figure for May since 1992.

The Society of Motor Manufacturers and Traders (SMMT) said this was the second weakest decline after the 2020 pandemic-hit the market as parts shortages continued to hamper new purchases and the fulfilment of existing orders.

When compared with May 2021, which was the first full month of dealerships opening after the pandemic, the dip in new registrations – despite strong order books – reflects how continued global supply chain disruptions affected the market. This was 32.3 per cent below the 2019 pre-pandemic level, the automotive trade association said.

In contrast, the battery vehicle segment increased by almost 18 per cent, representing one in eight cars or 12.4 per cent of total registrations in May. This is because manufacturers prioritised the supply.

“Electric vehicles have been flying off production lines this year, so much so that new EV registrations still seem highly likely to reach parity with petrol and diesel vehicles in a matter of months,” said Jon Lawes, Managing Director, Novuna Vehicle Solutions (NVS).

The NVS MD further said: “It’s a psychologically important tipping point, and one we are accelerating towards so quickly because prolonged supply chain challenges are strangling production across the industry, causing manufacturers to prioritise the supply of EVs in the face of healthy demand.”

According to Lawes, the recently emerging fears around battery supply have not had much impact yet to curtail the production of EVs, and certainly not to the same extent as across the rest of the industry.

“We’re very much in a sellers’ market, which points to further price rises, and longer waiting lists, which means consumers and commercial fleet operators need to plan well ahead and consider extending existing leasing contracts to cover the delay in new vehicle deliveries,” the MD said.

According to the latest data, registrations for Plug-in hybrids decreased by more than a quarter, while those of hybrids were up 12 per cent during the review period. This meant electrified vehicles accounted for three in 10 new cars.

According to the data, British motorists loved superminis the most, with the segment making up almost a third of total registrations in the month – that was despite a drop of 16.4 per cent to 40,667 units in the segment’s registrations. Dual purpose was the second most sought-after segment, accounting for 29 per cent of total registrations, but that segment, too, saw a dip of 14 per cent in registration number. The small volume luxury cars were the only segment witnessing growth, rising nearly 17 per cent to 369 units.

“To continue this momentum and drive a robust mass market for these vehicles, we need to ensure every buyer has the confidence to go electric,” Mike Hawes, SMMT Chief Executive said, adding, “This requires an acceleration in the rollout of accessible charging infrastructure to match the increasing number of plug-in vehicles, as well as incentives for the purchase of new, cleaner and greener cars.”