The Society of Motor Manufacturers and Traders (SMMT) has released new data indicating that the number of cars in use on UK roads increased by around 125,000 units to a total of more than 35 million in 2022 – a peak last seen in 2019. The overall number of vehicles has also increased to a record 40,723,974 units. Although these numbers are encouraging, it's not all good news. Indeed, some of the numbers just released show a worrying level of underinvestment in key sectors.

While growth in vehicles is a positive development for the UK's post-pandemic recovery, the data indicates that the bus and coach fleet has fallen by -2.3% to 72,766 vehicles (the lowest since records began), with 16,608 going out of service over the last decade. The data also indicates that the average car and van CO2 emissions have fallen by 1.6%, driven by the influx of new lower and zero-emission models.

The UK's bus services were largely privatised between 1980 and 1995 (although a dozen operators, country-wide, remain in the public's hands), which means that those companies have been making a profit and now need to invest in their own electric future. Are they ready to invest in new electric buses and infrastructure?

Ownership of electric commercial vehicles has also risen, with vans up by 67.3% and buses and coaches increasing by 34.9%, while the number of zero-emission trucks has almost trebled since last year.

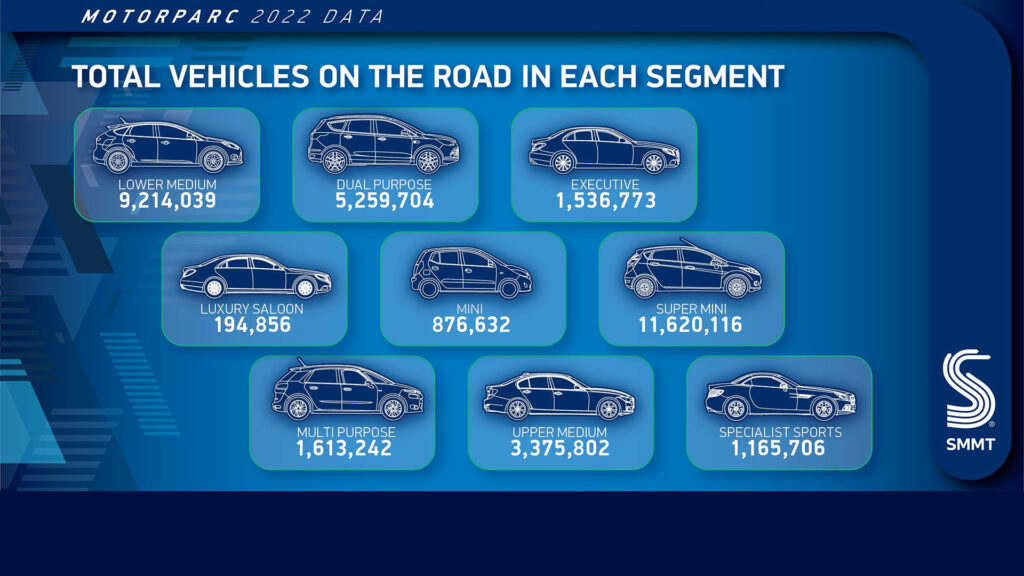

However, the average UK motorist remains predictable in terms of which size and colour of vehicle they prefer overall.

According to the information presented by the SMMT, public chargepoint rollout continues to lag behind EV uptake, with one standard public charger for every 36 plug-in cars on the road, down from 31 in 2021. Investment in appropriate infrastructure would energise uptake of the latest electric vehicles and accelerate fleet renewal to take older units off the road, helping to reduce the UK’s carbon footprint.

The UK’s bus and coach fleet has been declining for a while, falling by 2.3% in 2022 to reach 72,766 vehicles. This is the lowest number of buses and coaches since records began, with 16,608 going out of service over the last decade. The data shows that more than one in four buses has been in use for more than 15 years, indicating a need for support to encourage operators to invest in the latest zero-emission buses. This would be beneficial since buses and coaches are essential for providing mobility for millions of people and for road transport decarbonisation.

Mike Hawes, the Chief Executive of SMMT said, “The UK was on the road to recovery with the first growth in car ownership since the pandemic. While vans and trucks are delivering for business and society in ever greater numbers, the country is driving towards a net-zero future with more than one million zero-emission vehicles now on the road. With exciting new technologies and models fuelling the country's appetite to get back behind the wheel, now is the time to commit to greater investment in infrastructure and incentives, to speed up a switch to carbon-free mobility that is accessible to all.”

How important will the automotive industry be to the UK as a whole and the Government in particular, over the coming years? It is a vital part of our economy and integral to supporting the delivery of the agendas for levelling up, net zero, advancing global Britain, and the plan for growth.

Automotive-related manufacturing contributes £67 billion turnover and £14 billion value added to the UK economy – and typically invests around £3 billion each year in R&D. With more than 182,000 people are employed in manufacturing and some 780,000 in total across the wider automotive industry. That accounts for 10% of total UK global goods exports, generating £77 billion of trade.

In addition to the primary industry of car manufacture (where 25 inter-related brands build more than 70 models of vehicles in the UK), they are supported by plus an array of specialist small volume manufacturers with some 2,500 supply chain businesses involved in that sector. Many of these jobs are outside London and the Southeast, with wages that are around 14% higher than the UK average. The automotive sector also supports jobs in other key sectors – including advertising, finance and logistics.

It's clear that a co-ordinated plan is needed to move large sections of that industry and infrastructure across to an EV model in the very near future. Certainly if we are to have any chance of hitting the targets set for 2030 and 2050.