The UK new car market has seen what some traders said was the worst year in three decades as supply chain constraints hampered growth, but ownership of EVs continue to rise, making it the second largest car segment after petrol cars for the first time in 2022.

The Tesla Model Y was the bestselling EV, with the Model 3 second and Kia’s e-Niro third. Model Y sales were so strong in 2022 that it came third across all fuel types, coming in just behind the ever-popular Vauxhall Corsa and ahead of the Ford Puma.

The UK new car market recorded its fifth consecutive month of growth in December, with an 18.3% increase to reach 128,462 new registrations, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). However, this was not enough to offset the declines recorded during the first half of 2022, the SMMT said.

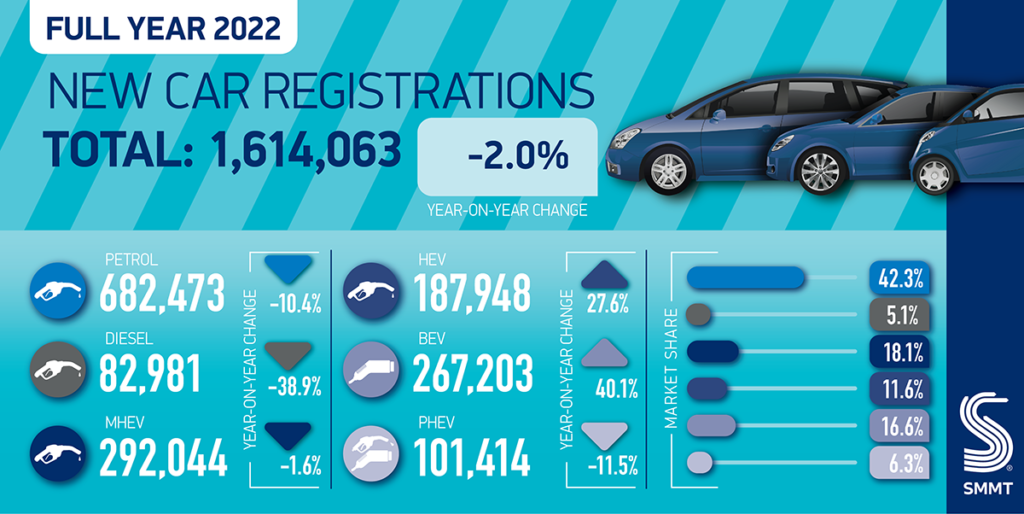

Despite underlying demand, pandemic-related global parts shortages saw overall registrations for the year fall 2% to 1.61 million, around 700,000 units below pre-Covid levels, the auto trade body said.

“The automotive market remains adrift of its pre-pandemic performance but could well buck wider economic trends by delivering significant growth in 2023,” SMMT Chief Executive Mike Hawes said, adding rapid investment is needed into the nationwide charging infrastructure.

According to the SMMT, constrained supply saw many manufacturers prioritise deliveries of the latest zero emission-capable models. December saw EVs claim their largest ever monthly market share, of 32.9%, while for 2022 as a whole they comprised 16.6% of registrations, surpassing diesel for the first time to become the second most popular powertrain after petrol.

“It’s no surprise to see EVs take a greater overall market share in 2022,” said Fiona Howarth, CEO of Octopus Electric Vehicles. “We’re seeing plenty of pent-up demand, with large order books and thousands of drivers waiting on their cars to be delivered as manufacturers try to bolster supply chains.”

The Octopus EV chief said the average driver can save well over £1,000 a year on fuel costs compared to an old school gas guzzling car, while being able to charge at home provides many with greater convenience. “There’s no doubt that 2023 will be another landmark year for the industry as we accelerate towards net zero transport.”

Meanwhile, plug-in hybrids (PHEVs) saw their annual share decline to 6.3%, meaning that combined, all plug-in vehicles accounted for 22.9% of new registrations in 2022 – a record high, although a smaller increase in overall market share than recorded in previous years, the SMMT data showed.

Hybrid electric vehicles (HEVs) also enjoyed growth, rising to an 11.6% market share for the year. As a result, average new car CO2 fell -6.9% to 111.4g/km, yet again the lowest in history, the auto trade body said.

“Last year ended with a better-than-expected increase in EV ownership,” said Jon Lawes, Managing Director, Novuna Vehicle Solutions. “We expect this positive trajectory to continue into the new year, despite supply issues continuing to hamper the industry’s ability to meet demand.”

The MD further said the road to net zero remains bumpy, with EV infrastructure failing to keep pace with adoption. “Our analysis shows that to hit Government targets, 30,000 new charging points will need to be built every single year for the next seven years, a tenfold increase in the number put in the ground in the past decade.”

The Government should make policies to encourage uptake of zero emission-capable vehicles during 2023, the SMMT said, criticising the plans to introduce VED on EVs from 2025 with the same ‘premium’ threshold as internal combustion-engine cars, which it said will disproportionately penalise those making the switch.

Last year, Britain reclaimed its position as Europe’s second largest new car market by volume, both overall and, specifically for plug-in cars. However, as of the end of Q3 2022, it was 13th overall by plug-in market share, behind markets including Norway (78.3%), the Netherlands (28.7%) and Germany (23.5%), the SMMT said.

Looking ahead, supply chains are beginning to stabilise and although the shortage of semiconductors is expected to ease, erratic supply will likely impact manufacturing throughout 2023, the trade body said. The most recent market outlook, published in October 2022, anticipates around 1.8 million new car registrations in 2023, worth around £8.4 billion in additional turnover.