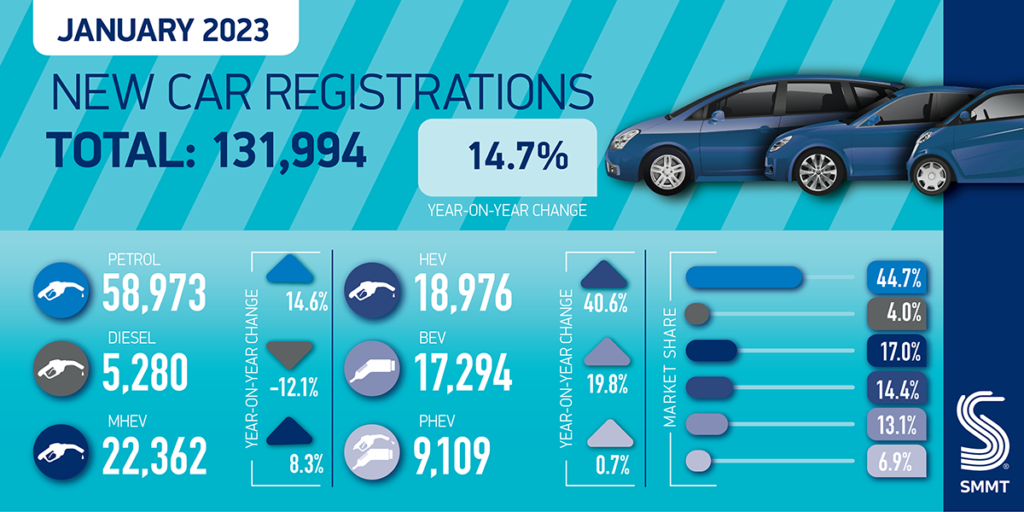

In a sixth successive month of expansion, the UK new car market grew 14.7% in January to reach 131,994 units, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

The growth was driven by electrified vehicles as manufacturers introduced more models and offered greater choice to the market, the SMMT said.

Hybrid electric vehicles (HEVs) comprised 14.4% of new car registrations, increasing volumes by 40.6%. Meanwhile, battery electric vehicle (BEV) registrations rose 19.8% to reach 17,294 units, or 13.1% of new registrations – slightly below the average recorded for 2022.

Plug-in hybrid vehicles (PHEVs) recorded a 0.7% rise, although their share fell to 6.9% of new cars reaching the road. As a result, one in five new cars registered in the month came with a plug.

It was also a strong month for large fleet registrations, which increased by 36.8% to 69,540 units, while registrations by private buyers fell by 4.3% to 59,639 units – reflecting some easing of supply and evidence of how shortages last year distorted market performance. Registrations by businesses, the smallest segment at 2,815 units, rose by 45.6%.

Plug-ins are anticipated to comprise of more than one in four new registrations this year, representing growth of 32.1% or approximately 487,140 units, and almost a third, 31% to be precise, of the market in 2024 at 607,150 units.

“The industry and market are in transition, but fragile due to a challenging economic outlook, rising living costs and consumer anxiety over new technology,” said Mike Hawes, SMMT Chief Executive. “We look to a Budget that will reaffirm the commitment to net zero and provide measures that drive green growth for the sector and the nation.”

The SMMT suggested that reducing VAT on public chargepoint use from 20% to 5% in line with home charging would ensure more affordable access for all and underpin a fair net zero transition.

According to the SMMT, the strong start to the year is mirrored in the latest market outlook, which anticipates 1.79 million new car registrations in 2023, an 11.1% increase on the past year but still well below 2019 levels. This also represents a 0.8% reduction on October’s outlook, against a weak economic backdrop. However, a further 9.3% increase is expected next year, with 1.96 million new cars expected to join the road in 2024, it said.

During the fourth quarter of 2022, the ratio of new chargepoint installations to new plug-in car registrations dropped to one for every 62 – a significant fall compared with the same quarter last year, when the ratio was 1:42. As a result, in 2022, one standard public charger was installed for every 53 new plug-in cars registered, the weakest ratio since 2020.

Mandating rollout targets for infrastructure and regulating service standards would give drivers certainty they can always find a working, available charger. Infrastructure must be built ahead of demand else poor provision risks delaying the electric transition, the trade body said.

“As registrations continue to bounce back at the start of 2023 in response to a gradual easing of supply chain shortages, there is cautious optimism within the industry for a sustained upturn over the coming months,” said Jon Lawes, Managing Director, Novuna Vehicle Solutions.

“However, maintaining this momentum relies heavily on increased Government-led intervention to prioritise an exponential growth in the rollout of public charge points, to match the demand for EVs, and clarity for the industry, on its commitment to introduce a ZEV mandate.”