Rising petrol and diesel prices drove more people to EVs, whose sales grew steadily in the UK, but supply chain distortions continued to hamper growth of the overall market in June, data from New AutoMotive has revealed.

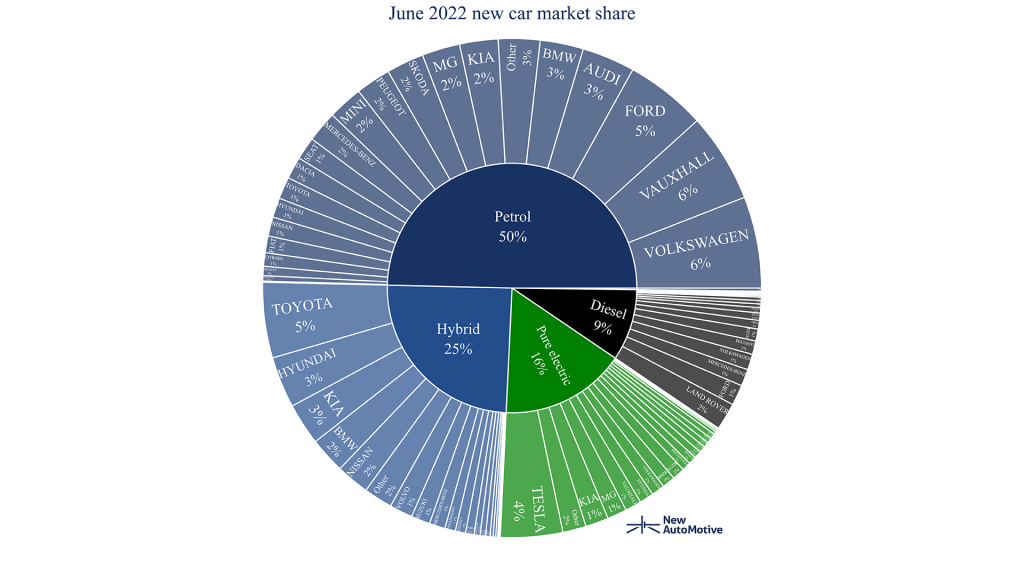

Total UK car registrations were down by 26% in June compared to the same month of 2021, indicating the impact of global supply chain disruptions on the supply of vehicles, as well as the impact of the cost-of-living crisis on consumer purchasing power, the transport research organisation said. Despite these headwinds, electric car registrations continued to grow, taking 16% of the market nationally, it said.

“Demand [for EVs] will only accelerate as we move towards zero emission transport,” Octopus Electric Vehicles CEO Fiona Howarth said, adding there are over 65 EV models to choose from, and the average driver is able to reduce their fuel bill by over £1,000 a year compared to a gas guzzler.

“Supply chains are a mess, but those car makers that can keep up will continue to gain market share and win new customers,” Howarth said.

With nearly one in every four EV sold, the Tesla Model Y dominated the Top 5 most popular models in the second quarter of 2022, followed by the Polestar 2 – the two models combined accounted for more orders than the next 10 models put together. The MG ZS EV, Tesla Model 3 and Mercedes EQA were also among the top five.

“We hear that the typical delivery time for electric cars is now between 40 weeks and a year. The supply of electric vehicles is the biggest barrier to cleaner road transport in the UK,” said Ben Nelmes, Head of Policy and Research at New AutoMotive.

Nelmes said the government’s planned California-style ZEV mandate should help attract a greater supply of electric cars to the UK, but its proposed target might fall behind where new registrations are headed – as per the target, car manufacturers should make 22% of their sales fully electric in 2024.

New AutoMotive’s policy and research head says it is vital that those targets keep pace with the market and drive up EV registrations to “give consumers the cars they want, reduce the cost of motoring, reduce the UK’s reliance on Russian diesel and cut carbon emissions: it’s a no-brainer”.

The transport research firm tracked regional registrations using a three-month rolling average to cover variations in EV market share from month to month. As per their findings, Oxfordshire had the highest share of EVs at 37% in the DVLA regions, followed by East Anglia with a 23% share. Northeast England and London had an 18% share each while Severn Valley had the smallest share in the EV market at 16%.