A report released today by the Green Finance Institute (GFI) emphasizes the crucial role that the second-hand electric vehicle (EV) market can play in accelerating the UK's transition to net zero emissions. The report highlights that addressing barriers to the used EV market, particularly concerns about battery health, could encourage over 17 million UK drivers to switch to electric vehicles. Battery health, affordability, charging infrastructure, and access to reliable information were identified as the top barriers to the second-hand EV market.

As the UK government plans to ban the sale of new petrol and diesel cars from 2030, the used car market is expected to become even more dominant. In 2021, used cars represented 82% of cars sold in the country, and the market is projected to reach a value of £182 billion by 2027. Encouraging the adoption of affordable EVs in the second-hand market is crucial to achieving road transport decarbonization, meeting climate targets, and ensuring a just transition.

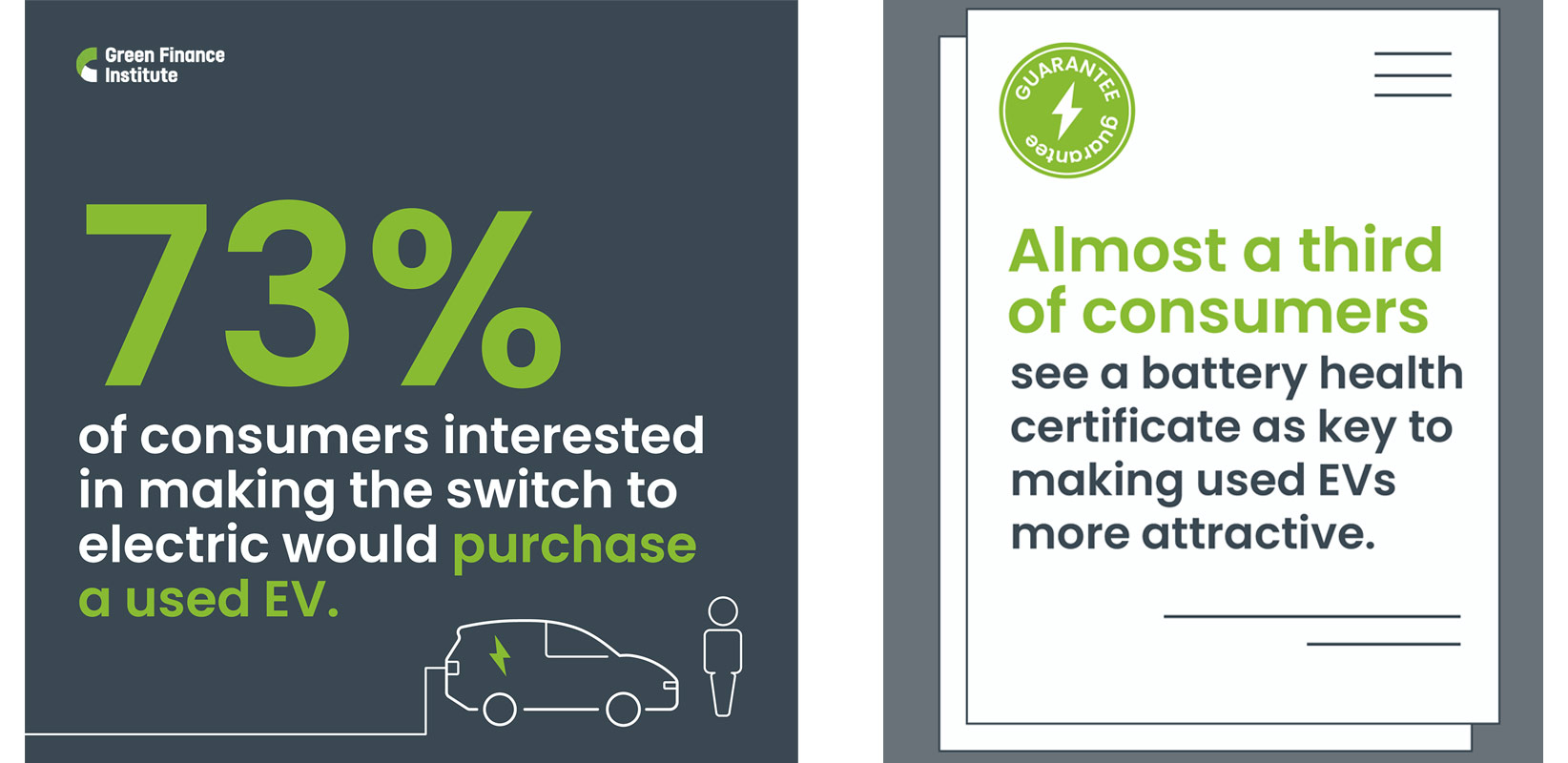

The GFI's report, titled “Used EV Market: The Key to Unlocking Net Zero,” surveyed over 2,000 UK drivers and drew on contributions from 35 leading car dealerships, motor finance lenders, and lease companies. It revealed that while 61% of drivers expressed interest in purchasing an EV, over a quarter of them would not consider buying a used EV due to concerns about battery health, cost, and charging infrastructure. Addressing battery health concerns was identified as the single most effective solution to encourage drivers to make the switch to electric vehicles.

Lauren Pamma, Programme Director at the Green Finance Institute, emphasized the importance of the used EV market, stating, “Without the used market, the EV transition is destined to stall. Our research makes clear that the demand for EVs is already there, but to unlock the used market, we need to boost consumer confidence on battery health, charging infrastructure, and affordability.”

“Due to the importance of the second hand market to the transition to zero emission vehicles, the Government convened a working group to identify potential barriers and solutions to the take-up of used EVs. This report presents some of the conclusions from the finance and data workstream of the working group. The Green Finance Institute will continue to work collaboratively with Government to develop the second hand vehicle market”, she explained.

Battery health emerged as the most significant concern among drivers, with 62% expressing worry about battery lifespan. Over three-quarters of the dealerships involved in the report recognized battery lifespan as one of the top consumer concerns regarding used EVs. However, research indicates that the overall running costs of an EV over its lifetime are typically lower than those of internal combustion engine (ICE) vehicles. In some cases, used EVs are even cheaper to purchase than their ICE counterparts, such as the Renault Zoe.

The report also highlighted the need for a better understanding of the cost and locations of public charging infrastructure. Although the number of public charge points has increased by 523% in the last six years, drivers still require clearer information to build confidence in EV adoption. Additionally, the report called for reductions in value-added tax (VAT) on public charging rates to match the lower rate for home charging (5%), combined with finance packages that include both the vehicle and home charging costs.

The GFI proposed several solutions to overcome the barriers identified, including Battery Health Certificates, Battery Value Guarantees, and Battery Passports, which provide standardized certification, guarantee end-of-life values, and accurate information about the battery's life, respectively. The report also stressed the importance of agreed definitions and standardization of metrics for Total Cost of Ownership Calculators to provide clear comparisons between EVs and ICE vehicles.

Dealerships were identified as key players in addressing gaps in consumer education. While they were trusted sources of information on EVs, the report highlighted that dealerships require more data on battery degradation to effectively address consumer concerns.

The Green Finance Institute is collaborating with financial, policy, and automotive partners to develop and pilot these proposed solutions to boost the uptake of used EV. The proposed five-point action plan centres on:-

- Battery Health Certificates

A standardised battery health certification scheme for used vehicles) and Battery Value Guarantees (a mechanism for EV batteries to have a guaranteed end-of-life value) were most commonly identified by drivers as solutions that would encourage them to make the switch to electric, at 31% and 30% respectively - Battery Passports

Designed to give second-hand buyers accurate knowledge of their prospective battery’s life to date, would also help allay concerns over batteries - Total Cost of Ownership Calculators (TCOC)

Agreed definitions and standardisation of metrics for TCOS would help paint a clear picture of the total lifetime costs of EVs compared to ICE cars, including fuels and maintenance - Information Holes

Addressing information gaps, particularly surrounding topics such as the cost and location of public charge points, as well as energy tariffs to keep at-home charging costs low, will be central to giving drivers the confidence to switch to an EV - Less VAT

Reduction on the rate of VAT on public charging (20%), to match that of home charging (5%) – four times less. This, coupled with combined monthly finance packages inclusive of both vehicle and home charging, will be vital for building consumer confidence in the affordability of EVs

For all of the barriers identified throughout the report, the research showed that dealerships have the greatest potential to address gaps in consumer education. Outside of personal research and family & friends, dealerships are the most trusted source of information on EVs (27%). However, dealerships are also in need of more information on EVs. Just two out of the 21 dealerships involved in the research felt they had enough data on battery degradation, with the remaining in need of more information.

Certainly, when WhichEV engaged in primary research on the UK main dealer network, there was a worrying lack of knowledge on the benefits of EVs and a somewhat reluctant approach to selling them – specifically online in a way that did not require direct dealer contact.

Let's hope that the Government addresses the issues raised by this report, before they become market blockers in the real world second hand market.

Discussion about this post