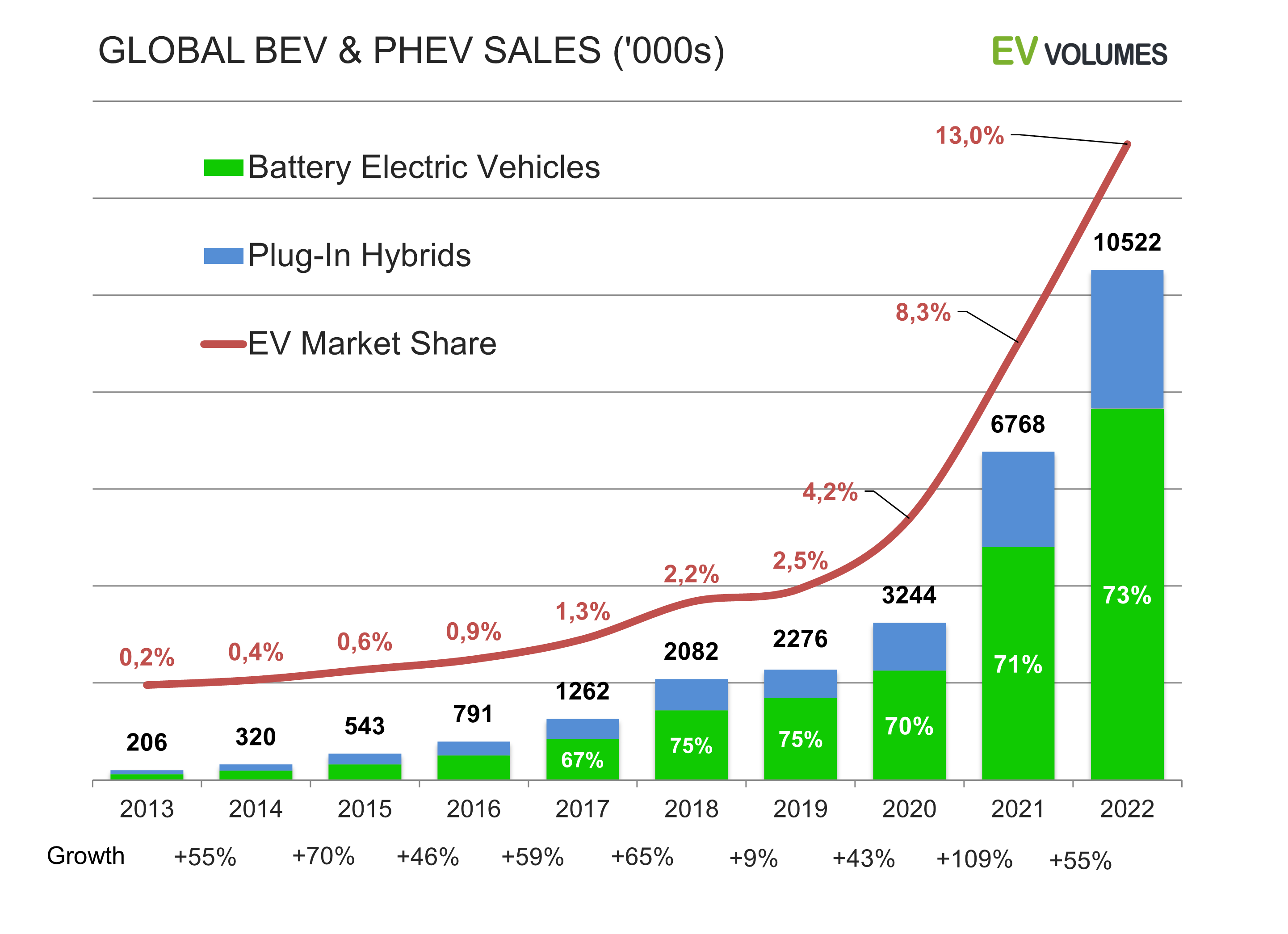

Global sales for BEVs and PHEVs rose 55% year over year to 10.5 million units in 2022, according to a report by global EV database EV-Volumes.

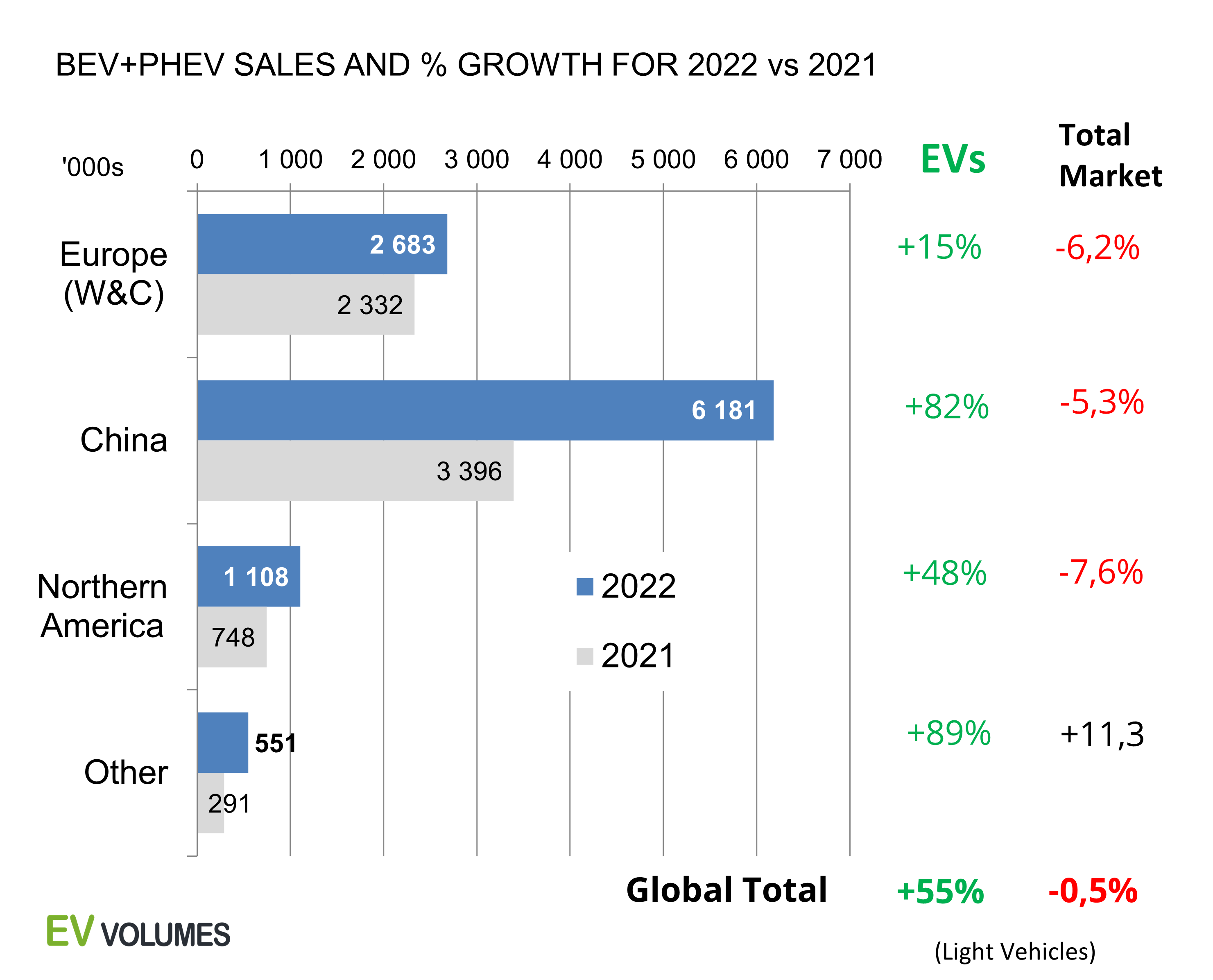

Following two years of steep sales increases in Europe, EVs gained only 15% in 2022 compared to 2021 in the region. Weak overall vehicle markets and persistent component shortages have taken their toll, exacerbated by the war in Ukraine, a press release said.

However, EV sales in the U.S. and Canada increased by 48% year over year, despite a weak overall light vehicle market that plunged by 8% during 2022, the release said, adding that the second half of 2022 saw a cautious recovery of auto markets.

Global light vehicle sales for 2022 were 81 million units, 0.5% to lower than 2021’s tally and 15% below pre-2020 levels.

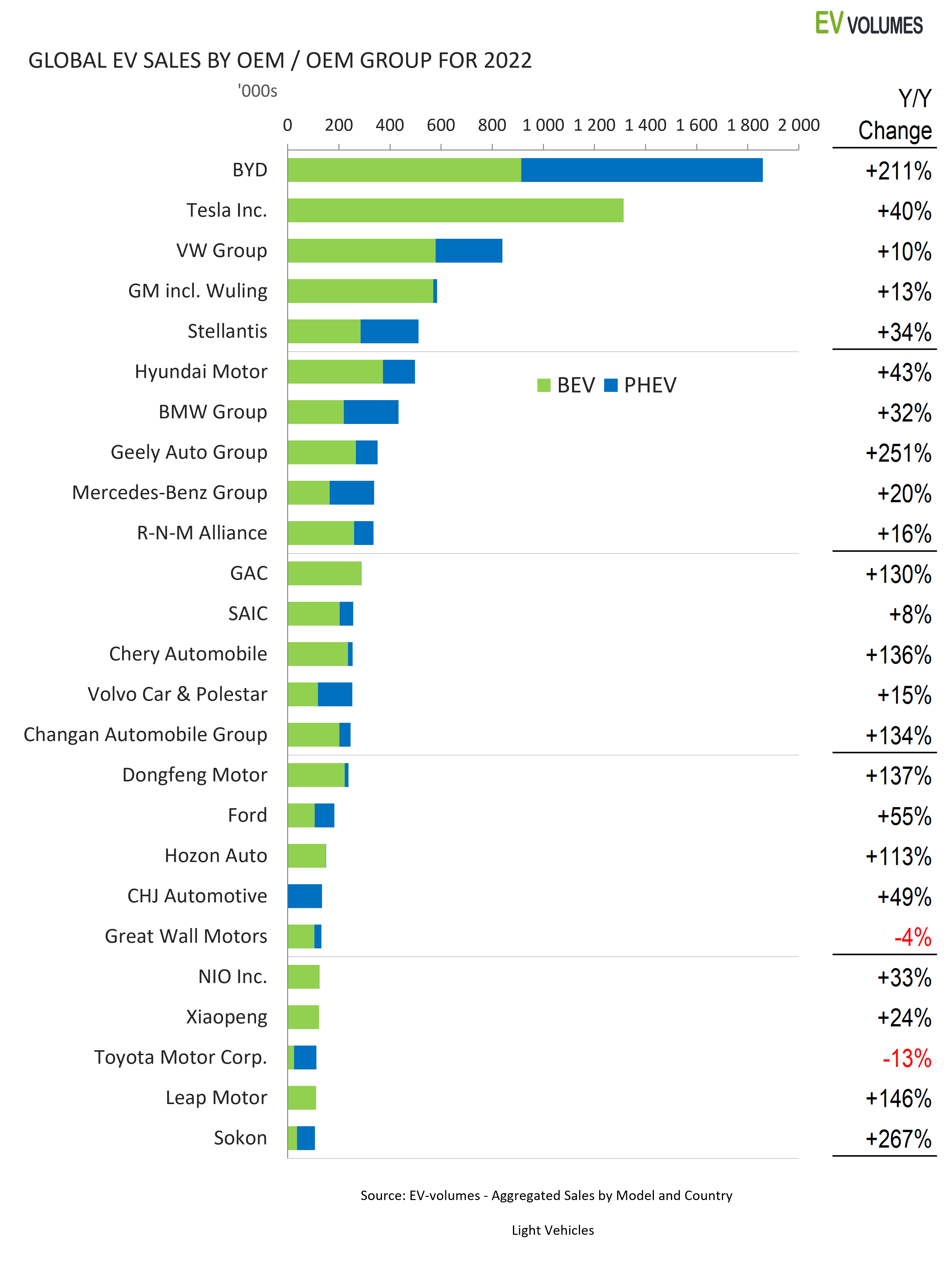

Meanwhile, China new energy vehicle (NEV) sales increased by 82% year over year. BYD more than tripled sales to 1.85 million units, making it the number in the global sales ranking, inclusive of the brand’s 944,500 PHEV sales. Counting BEVs only, Tesla still leads by a wide margin with 1.31 million units delivered in 2022.

PHEVs stood for 27 % of global plug-in sales in 2022 compared to 29% in 2021. While their sales volumes still increased, their share in the plug-in mix is in decline, facing headwinds from incentive cuts and improving BEV offers, the release said.

Rapid EV adoption in weak auto markets has boosted EV shares further. BEVs (9.5%) and PHEVs (3.5%) stood for 13% of global light vehicle sales in 2022, compared to 8.3% in 2021. Norway had the highest market share of EVs in the first half of 2022, with 71% BEVs and 8% PHEVs; China had 27%; Europe 20.8% and U.S had 7.2% share.

The fastest growing markets were Indonesia, which grew from 1,000 to 10,000; India with 223% increase to 50,000, nearly all BEVs; New Zealand’s market rose by 151% to 23,000 units for 20% market share. EV supply and adoption is now spreading rapidly into the global south, the release said.

The last two months of 2022 saw demand distortions by coming reductions of EV grants in Europe and China and the IRA in the U.S. for 2023. Demand for EVs and ICE vehicles alike were pulled into 2022 or pushed into 2023, the release said.

The world EV sales database provider expects irregular EV sales and shares in several countries for the first quarter of 2023. “For the full year of 2023, we expect sales of 14.3 million EVs, a growth of 36% over 2022, with BEVs reaching 8 million units and PHEVs 2.6 million units,” it said. “By the end of 2023, we expect nearly 40 million EVs in operation, counting light vehicles, 73% are BEVs and 27% PHEVs.”

Most mature auto markets experienced double-dips in sales during the 2020 through 2022 period, the release said. Following the Covid crunch of 2020 and a 5% recovery in 2021, 2022 sales dipped again, by 0.5% compared to 2021’s tally, with mature economies losing 5% to 10% of auto sales.

Discussion about this post